FICO | What the Hell is Going On? - Full Write Up

A look into FICO and the misunderstood threat to it's monopoly status

FICO

Its one of those companies I think many of us wish we had caught onto sooner - I sure do…or I did anyway.

FICO appears to be a capital light, pick and shovel on consumer credit with a strong moat and fantastic economics. Until recently, FICO had no meaningful competition in a few very key parts of their business. Moreover, there was no real way around pulling your FICO score upon purchase of a house (or car for that matter). And finally, many argued that, since the cost of a credit score (a few dollars) was peanuts in comparison to closing costs on a home (thousands of dollars), FICO could raise prices a lot without anyone really noticing (or caring for that matter).

That was the idea anyway…

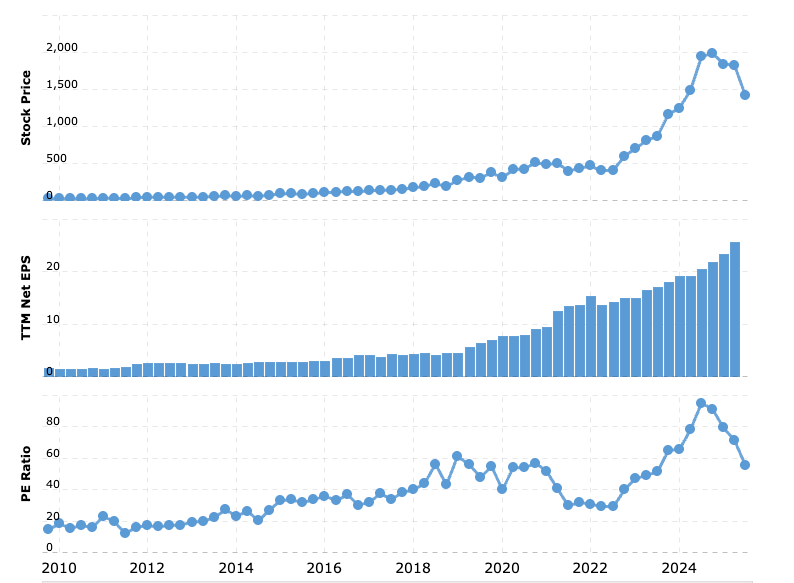

FICO’s stock ran up about 500% from 2020 into the beginning of 2025, but recently its fallen rather sharply. FICO’s stock is down -30% year-to-date while the S&P is up about 10% over the same period. Despite this fall, FICO still trades at a lofty 55 TTM PE ratio.

So investors may wonder, at what point is this a good value?

I’ve had my eye on FICO for a while, but was always put off by the high price relative to earnings and cash flow. Now that the stock is down 30% on the year, I thought perhaps I’d take a deeper look at exactly why it fell, as well as whether or not 30% is enough of a “sale” for this boring but powerful juggernaut.

What I found surprised me.

Part 1: The Business

FICO is a company that makes money by licensing it’s credit scoring algorithm (used in nearly every major consumer loan decision), and also by selling decision-management software that helps banks and businesses automate risk, fraud, and customer decisions.

In short, FICO makes money as a small toll booth in the world of risk and consumer lending. When someone lends money, they want to be able to gauge the odds of being paid back. There are many factors we can look at when deciding how “credit worthy” a person (or business) is. We can see their income, history of payments, existing debts, assets, other liabilities, ect ect. Basically, its complicated to amass all this information into one number (score) that actually means something. Once you know how credit worthy your perspective customer is, you can get an idea of how much money you ought to lend them, and on what terms (e.g: interest rate).

Banks, who’s entire business is essentially just loaning people’s money to other people, really need to know how credit worthy those borrowers are. Moreover, they need to be able to scale this system of “knowing if they’re going to get paid back” across millions and millions of different loans. That means that they need a system that is fast, accurate, and somewhat universal.

Enter FICO.

FICO’s business can be divided into two main categories: Scores and Software.

Scores (~54% of 2024 Revenue)

If you’re American and you’re reading a write-up on FICO, you probably already know about FICO scores. For the Europeans out there - or just any Americans who aren’t aware of this score - its basically a number between 300 and 850 (don’t ask me why those are the numbers). The closer you are to 850, the lower your odds of defaulting on a loan are (according to the data anyway), and the higher the odds of you getting approved for a loan.

This is the “scores” business. In the U.S, if you want to take out a loan for a house, car, or even a credit card, you must have a FICO score. No one is going to loan you money because you have a great smile - they want to know they’ll get paid back with interest.

Makes sense right?

The FICO score is basically the go-to algorithm for all consumer lending in the U.S.A, especially in the world of mortgages.

Auto-loans, credit cards, and any other miscellaneous loans also mostly use FICO scores to gauge credit-worthiness, but mortgages in particular rely on the FICO score. Why?

Fannie Mae and Freddie Mac - which buy and guarantee nearly half of all U.S. mortgages - required FICO Scores on every loan they purchased. That rule effectively forced every major lender to adopt FICO, since banks wanted to be able to sell their loans into the secondary market. Remember the Big Short? When Michael Burry actually looks through the mortgages and notes the low FICO scores for many of the borrowers? Yeah, this is what he’s talking about.

Over time, entire risk models, loan pricing systems, and regulatory compliance processes were built around FICO. The result was a huge amount of inertia: lenders trusted it, regulators recognized it, and investors expected it, making FICO the safe, default choice for mortgage underwriting.

But here’s a fun fact: FICO does not own the data it uses to generate those scores.

We’ll get there, don’t worry.

Back to scores.

Essentially, the massive and complex U.S economy is made up of a lot of debt, and plenty of that debt is individual debt (you and me). When we take out a loan from a bank for a house, car, or whatever else, the bank may quickly turn around and sell that loan to another bank. That second bank may sell it to a third, who sells it to a fourth, and so on and so fourth. In the end, who ever is holding my loan on their books is going to have to answer to regulators and insurance companies as to the solvency of their debt portfolio. In other words, “how safe are the loans you guys have?”

Banks also borrow money from other banks, and those other banks want to know how credit worthy the first bank is. And it goes on and on like that. Everyone wants to know how “solvent” everyone else is, and one of the key ways they do that is with FICO scores. Now, to be clear, the FICO score is for individuals, not institutions. But institutions do need to answer to both regulators (as well as other institutions) as to how solvent they are. If a bank holds a bunch of loans to people with sub-600 FICO scores…yeah…they may not hold up too well in a financial crunch.

In the end, the FICO score is just an algorithm that indicates risk, and its the main focus of the current conversation around FICO. There is another segment of the business, however, that is also worth discussing if we’re going to get a full picture of FICO.

Software: “FICO Platform” (44% of 2024 Revenue)

Ok, so as you might imagine, large (and small) institutions have to make a lot of decisions every day - many involving risk. Some of those decisions may be bigger (loaning millions to a business), and some are smaller (loaning me money for a motorcycle). Other decisions include whether or not to insure my motorcycle (or me for that matter), as well as something as basic as whether or not i’ll pay my phone bill.

There are all sorts of questions businesses need answered:

“Is this fraud?”

“Should we approve this customer for a loan?”

“What interest rate should they get?”

“Do we need a deposit before we connect their electricity?”

“Which of these overdue borrowers is most likely to pay if we call them?”

“Which customer is worth sending a special offer to, and which one is about to leave us?”

“Is this login attempt suspicious?”

“What premium should we charge this applicant?”

“Is this borrower going to default in the next 12 months?”

“What’s the right credit limit for this new cardholder?”

“Should we restructure this loan or send it to collections?”

…the list goes on and on.

Usually, FICO Platform customers are going to be Banks/Credit Unions, Insurance Companies, Credit Card Issuers, Telecom/Utilities, and FinTech/Digital Lenders.

So…basically just money lenders, insurance companies, and utilities. Don’t get too excited and think Chipotle and Nike are going to become FICO Platform customers anytime soon. This space of “decision making software” is more competitive than the scores business since its less regulated, but when it comes to money lending and risk assessment, FICO’s reputation proceeds it; making FICO a strong player in this niche.

So, now that we understand the business qualitatively, lets take a look at some numbers…

Numbers

What you’ll see below are some pretty excellent figures for FICO. Top and bottom line have both grown pretty substantially over time - particularly in the last 5 years.

Ok, so Revenue, Net-income, and Operating Cash flow are all moving up and to right - exactly what you want to see in a business. No surprises there.

Lets take a look at FICO’s margins…

Notice how margins increased somewhat dramatically after 2020? Remember that, because we’re going to talk about it later.

No thats not a glitch you see in ROE. The weird drop into the negative for ROE has to do with FICO’s management opting to leverage the hell out of their business. FICO has more long term debt than they do assets, and so shareholder equity went from nothing to negative - hence “return on equity” being negative.

Lots of debt may sound bad, but I regard this as a management team who knows their income stream is solid, and wants to give everything they can back to the shareholders. Like I said, this debt should be regarded more as “leverage” since the companies apparent returns on capital are easily higher than their cost of capital.

As you can see, they have buybacks switched on in a big way, and management happily returns excess cash to the shareholders. All good right?

Lets take a look at the valuation over time, since this is what most people (myself included) were complaining about when it came to FICO.

The TTM PE ratio spiked around 90! - A huge valuation for FICO, and one that kept many investors on the sidelines. That said, ever since the share price fell, the PE has as well. You’ll notice EPS are still growing despite the fall in stock price….interesting no?

So lets talk FICO over the last five years. Here’s another interesting chart for you….

The above chart is not from FICO, its from the FRED. That chart can be used as an analogue for consumer mortgage activity - the bread and butter for FICO’s scores business. As you can see, mortgage originations have plummeted since their peak in 2021…but wait…lets pull up that FICO net-income chart again:

Yes, FICO earned more income during a secular decline in consumer mortgage origination. How? Easy

Pricing Power

One of the crucial components for FICO’s bull case was the company’s monopolistic grip on the consumer lending industry - particularly when it comes to mortgages. Legally, only FICO scores were acceptable for mortgage lending. FICO also holds a dominant position in auto-loans and credit cards, but nowhere is FICO more ubiquitous than in the world of mortgages.

From 2020 to 2025, FICO increased prices per score by ~400%, hence the massive increase in net-income amidst a rapidly declining mortgage market. 400% may sound like a lot, but for reasons you’ll soon understand, most home buyers don’t really think about the cost of their FICO score.

FICO scores cost only a few bucks in the face of thousands if not tens of thousands in closing costs on houses. This relative “cheapness,” along with FICO’s monopolistic position in the world of consumer mortgage lending has led many to believe FICO possess massive pricing power. Name any other company that could raise prices 400% in a few years and you wouldn’t notice. That is the beauty of FICO…or at least it was.

Because as of July 8th of 2025, the FICO score is no longer the only game in town. That is no secret, but the details surrounding it often seem to get lost in some of the FICO bull cases i’ve heard.

Here is where things get interesting, and also where people truly misunderstand the FICO situation…