Copper | A Comprehensive Guide

A deep dive on the worlds most important metal. Who has it, who needs it, and so so much more.

Buried underneath the dirt of Chile’s Atacama Desert are shiny little deposits of a reddish brown metal - 9 kilos of the stuff for every 1 tonne of rock and sediment. Its an ancient metal which shingled the roofs of Roman emperors, plated the ship-bottoms of the British Royale navy, and now powers our entire world. Without it, we as a species would be stuck in time; unable to advance our civilization beyond a candle-lit world of technological darkness.

Copper brings light to our cities, power to our homes, and water through our walls. Its uses are vast and its supply is scarce. The history of mankind and his ability to harness energy, be it from fossil fuels, the wind, the sun, or the splitting of the atom, is in its early chapters. Our journey towards a new world of diverse, renewable, carbon-free, and sustainable power is both worthwhile and difficult; a long trek on a winding road with one massive bottleneck: Copper.

If you’re interested in understanding and learning more about this shiny metal - often referred to as “Doctor Copper,” then you’re in the right place. As someone who is invested (somewhat directly) in copper, it seemed necessary to me to wrap my head around this resource:

What is it? Why is it special? What is it used for? How is it mined/produced? Who has it? Who needs it? How much of it do we use?

I wanted to know everything I could about this ever-more-important resource.

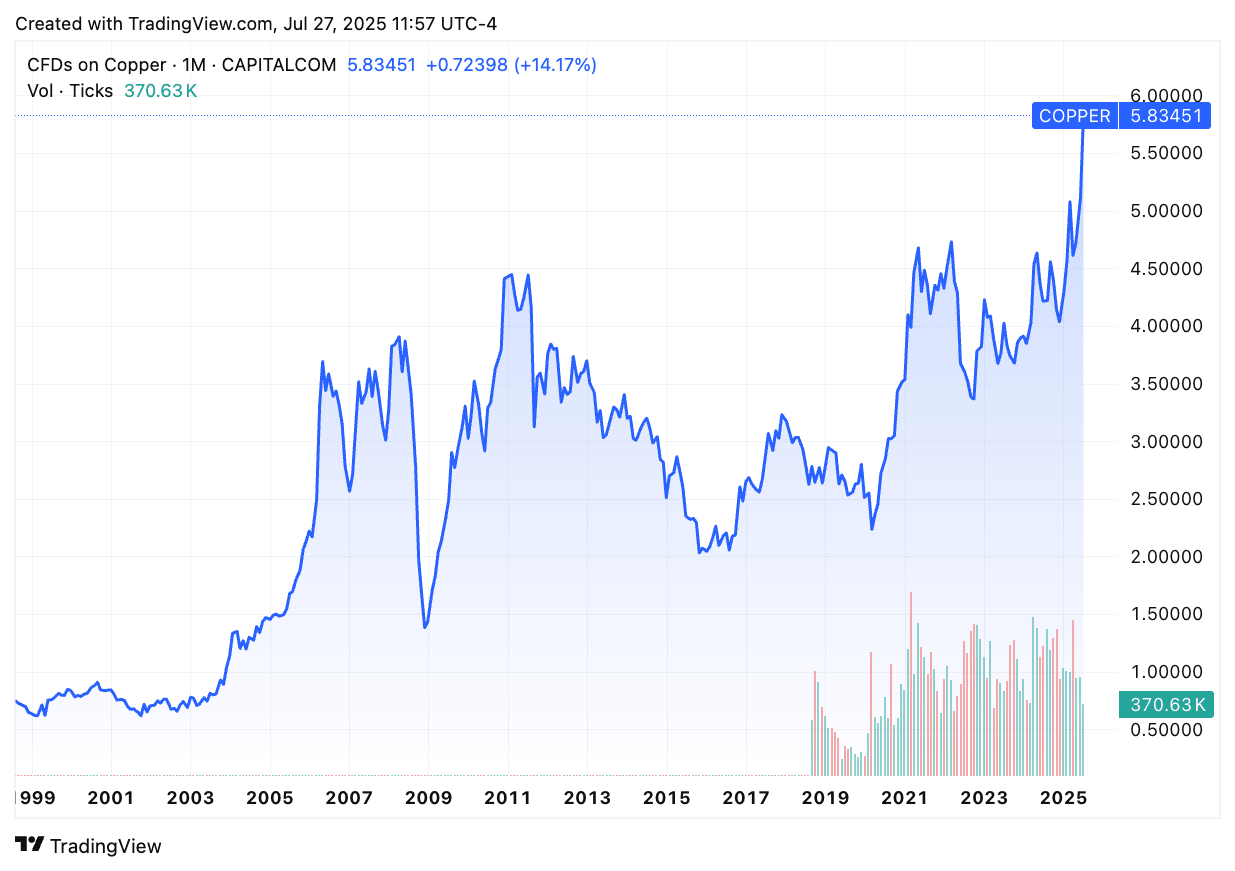

The other thing I want to understand is why the red-brown metal is suddenly soaring to all-time high prices.

So lets get into it.

Part 1: Doctor Copper

Why “Doctor” Copper? Well, Copper is an integral part of so many facets of our economy (building, manufacturing, electronics, and infrastructure), that copper demand can serve as a sort of “thermometer” for how the overall economy is doing. Lots of demand means things are getting hot, and the same principle cuts the other way. Recently, some of the price hikes we’ve seen on copper may be somewhat more related to lack of supply (and tariffs), so bear that in mind as we move forward.

Still, copper is a unique metal with a few very special properties which make it quite useful for many different applications. Conductivity, durability, malleability, and corrosion resistance are some of the key characteristics that make this shiny metal a friend to modern civilization. Your plumber and your electrician rely equally on copper and its unique attributes to do their job. Appliances, transportation systems, energy infrastructure, and even large data centers all need copper to function.

In the early industrial age, copper was used for everything from ship-hulls to coins, from gutters to clocks. In a post-Edison world, however, copper’s uses took on an entirely new importance.

Today, Doctor Copper is needed by all nations, but produced in large quantities by only a few. As the electrification wave takes hold in the West, and new economies rise in the East, the demand for this crucial metal only increases. Mitigated somewhat by re-use and recycling, copper’s demand has begun to outweigh its supply - driving the price of this metal to all time highs.

Before we get to the maps and charts, lets step back a ways in time and look at copper’s ever more important role in humanities evolution.

Part 2: A “Brief” History of Copper

Today, economists use copper demand to gauge industrial health, but archaeologists also use copper adoption to benchmark societal complexity of long-lost civilizations.

In the early days (9000 B.C.E), people saw copper nuggets in riverbeds and thought “ooohh shiny,” and that was about it. Now, to be fair, these were stone age folks, and their copper refining process was basically just banging the ore into shapes with a rock - no melting, just smashing.

Fast-forward about 3000 years and some people (mostly near the Balkans) actually started melting the copper ore. This was pretty crucial as it gave way to the lesser-known “Chalcolithic” age (copper-stone age) - which led, of course, to the famous Bronze age in ~3000 B.C.

Copper plus a dash of tin (Bronze) armed Mesopotamian armies and filled Egyptian tombs. The Romans called it aes Cyprium, meaning “Cyprus metal,” which led to the Latin name, “Cuprum,” which, in turn, explains the atomic symbol in the periodic table: “Cu.” ….Fun stuff I know.

The Romans turned copper from a crude craft metal into a workhorse for an empire. By the 3rd century B.C.E the Republic was striking the world’s first mass-issued copper coins, and under Augustus, pioneered large-scale minting of brass (copper and zinc); the earliest known industrial production of a true copper-zinc alloy (brass).

Imperial engineers then wove the metal into infrastructure: bronze clamps held monumental stone blocks; entire temple roofs (the Pantheon’s included) were sheathed in shiny copper tiles; and bath complexes ran hot water through copper pipes and valves. That is the first documented instance of urban plumbing to use a corrosion-resistant, antimicrobial metal (copper) rather than just good old lead. At the same time, copper alloys gave Romans their iconic bronze doors, artillery fittings, cookware and statues, all produced in foundries whose scale and technical sophistication would not be matched again until the early modern period. In short, Rome showcased nearly every major civil and military application of copper known to antiquity, setting templates - coinage, roofing, plumbing, architectural hardware; all still recognizable two millennia later.

So lets see, they kill Caesar, then Pax Romana, then a few hundred years of expansion, Christian Emperors of Rome, Rome falls to the barbarians, and then copper production goes a bit quiet for a while until the 10th century when parts of now-Germany and Hungary start re-opening old copper mines and using it to mint coins.

Europe itself starts to sit back up, and copper mines are being built all over mainland Europe, Scandinavia, and England. Gunpowder comes on the scene and suddenly “blasting” becomes a new part of mining, boosting copper production along with it.

In Asia, Japanese pits at Ashio and Sumitomo’s forerunners shipped refined metal to China and Europe via the Dutch East India Company.

By the 1600s Sweden’s Falun mine alone supplied an estimated two-thirds of Europe’s copper - essentially funding the Swedish Empire.

Copper is back.

By the mid 1700’s, copper had become a geopolitical weapon. Britain began coating the bottoms of their massive warships with copper, cloaking wooden hulls in thin plates that repelled shipworm and marine weed - enabling the Royal Navy to outrun its rivals.

Back on land, a man named Matthew Boulton used steam presses to crank out the chunky 1797 “cartwheel” penny - mass producing pure copper coinage with an accuracy that astonished the era’s counterfeiters.

And then came the Telegraph.

Today, most of us are quite familiar with these things called “wires” which transmit electricity, but they only really began to be “a thing” back in the mid 19th century. Samuel Morse strung the first telegraph line in 1844, and twenty-two years later the trans-Atlantic cable stitched continents together with seven strands of drawn copper, and demand for the metal exploded.

Spain’s mines in South America - whose origins date back to the Inca’s - began churning the metal out like clockwork. Mining itself became more advanced to meet the needs of this new industrial era, and the new found capacity to produce the metal set the stage for its next source of demand: electricity.

The dawn of this new century would be illuminated not by sunlight, but by electric current. And so with the birth of the lightbulb came the advent of the electric grid. All over the world copper wires transmitted electricity - this new and important force - from source to destination; lighting the homes of millions.

A seemingly infinite array of developments took place from 1900 to today; so much so that I could spend the entire article simply discussing them. Washing machines, War machines, calculators, computers, satellites, the internet, smart phones, AI data-centers - all these things and so so many more made possible by the same metal the Romans used for roofing.

And just like the Romans, we still use copper piping in our homes. So as the birth of the middle-class ignited an explosion in home-building, yet another massive demand source for copper arose.

Not a damn thing happens today without copper. It has found a permanent home in human civilization, and unlike gold or silver perhaps, copper pays the rent with its intrinsic utility - not just its shiny glint.

Part 3: The Workhorse Metal (why it’s awesome)

Copper’s many uses stem directly from its atomic characteristics. In other words, the very nature of this metal - this element of the universe - is special.

There are four main properties that make copper so useful to us (besides its shine and shimmer).

The first is its corrosion-resistance. Copper - also called the “eternal metal” - does not rust away. Instead, if exposed to the elements for a long period of time, Copper will eventually form a green patina. You’ve seen this patina before on the famous “Statue of Liberty” - an iron structure sheeted with copper plates. The simple fact that copper doesn’t decay over time when exposed to moisture (think roofs, pipes, statues, coins, ect), earns it the name I mentioned earlier “the eternal metal.”

But resistance to rust wouldn’t matter if copper was impossible to manipulate into various shapes and sizes. It’s copper’s malleability, ductility, and overall fatigue strength which make it incredibly versatile in the many tasks it performs for humanity. Not only is the red metal quite bendable and shapeable, but its also extremely ductile. Copper can be transformed into hair-thin wires that run for incredibly long stretches. Moreover, those copper wires can be wrapped, un-wrapped, thrown, bent, stepped on, ect, and still remain in one piece. As a guitar player who’s owned many cables (wires) over his life, I can attest that copper is a surprisingly resilient material considering how malleable it really is.

“Anti-microbial” may sound like a pretty fancy term to use for a rock thats been pulled out the ground, but believe it or not copper is (in simple terms) inherently sanitary. Bacteria, fungi, and other microbes get pulverized by the copper ions, and so no organic life can really live or grow on copper - even after it oxidizes and gets that green patina. Copper’s anti-microbial nature makes it particularly useful in plumbing, and has even earned copper a place on door handles in hospitals.

Last, but perhaps most important is copper’s incredible conductive capacity. Copper is second only to Silver in this regard, but silver finds itself lacking in ductility (tough to make a good wire out of it) - plus its way more expensive per pound. When humanity wants to send an electrical current from point A to point B it must use copper to do it. Whether were talking about a laptop charger or giant power lines along the highway, it is copper wire ultimately transmitting all electricity on Earth.

Moreover, the components we ultimately plug into this electricity (smart phones, toasters, speakers, air conditioners, ect) need copper to function. Small copper wires are everywhere - inside everything from the walls in our house to musical instruments to sex toys. Regardless of which technologies will power the world in 100 years (coal, solar, nuclear, ect), basic physics dictates it will almost certainly be copper transmitting that power.

Moreover, copper is also a great conductor of heat. This makes it ideal for HVAC units and heat-sinks for computers and data-racks.

Part 4: The Who, the What, and the How Much

Ok, so now we know the basic function of copper and what makes it so special. Lets take a look at where all this copper ultimately goes. Below you’ll see two charts - one depicting copper end use in the U.S and the other across the globe. This should give you a rough idea of how much copper goes towards which sectors and industries. Here’s a rough guide to the contents of each “sector.”

Electrical & Infrastructure: Power-utility gear, telecom/data cable, business electronics, motors, wiring devices

Building Construction: Building wire, plumbing tube, HVAC coils, architectural sheet

Transportation: Auto, rail, ship, aircraft & EV copperDirect match in both sets.

Industrial & Consumer: Factory machinery, valves, appliances, coins, utensils, misc. consumer goods

The difference is U.S Copper end-use vs the rest of the world can be accounted for by understanding:

1) U.S homes are overall much larger, and also simply use more copper (Asian homes often don’t use copper piping) and

2) A ton of electronics and motor manufacturing is done overseas.

Now that we have a broad view on copper’s end use, I think we can get a bit more specific. For now we can talk globally (before I break out the maps). Lets look a little closer at each segment globally:

Construction & building wiring = 17%: Miles of copper wire in walls; demand tied to housing starts, commercial builds, and retrofit cycles.

Consumer electronics & appliances = 17%: Fridges, heat pumps, compressors, PCs/TVs. A persistent source of demand; supported by replacement cycles and EM penetration.

Power distribution & grid = 15.5%: Cables, transformers, switchgear, substations. Slow, regulated capex; hard to substitute when you care about losses and footprint.

Plumbing, Heating/Cooling, & Water systems = 11%: Pipes, fittings, HVAC coils. Cyclical with construction, but replacement/maintenance gives it a steady baseline.

Automotive & EVs = 11%: Autos dominate transport copper. EVs run ~3-4× the copper of ICE—motors, inverters, busbars, high‑voltage wiring.

Industrial machinery & equipment = 11%: Motors, drives, control panels, process kit.

Renewables (wind & solar) = 5%: Small today, climbing fast. High copper intensity per MW means deployments pull real tonnage as the fleet grows.

Telecom networks & premise cabling = 2.5%: Twisted‑pair/coax and in‑building copper. Fiber trims the share, but copper hasn’t vanished.

Consumer & general brass products = 2%: Coins, locks, cartridge cases, hardware, instruments—small parts at massive scale.

Specialty valves, fittings & instrumentation = 1.7%: The hidden copper in process industries - valves, meters, precision fittings.

Thermal power generation = 1%: Big energy, small copper. Plants are comparatively copper‑light per MW.

Aerospace = 1%: Wiring, avionics, alloys. Important, but tonnage is tiny versus autos/appliances.

Trains & rail = 1%: Catenary lines, traction motors, signaling. Grows with electrification, still a small global slice.

Data centers = 1%: Servers, UPS, chillers, chunky copper in power backbones. AI is a tailwind for future copper demand (depending on how cooling technology plays out).

Marine & desalination (Cu‑Ni) = 1%: Corrosion‑resistant alloys for seawater piping and heat exchangers.

Medical & scientific instruments = 0.8%: Imaging/diagnostics gear, hospital electrical and shielding.

Nuclear power generation = 0.5%: Same story as thermal - niche in copper terms despite meaningful electricity share.

And finally lets just get our heads around how much copper is needed for various applications across our lives (for context).

Ok, so by now I think we have a clear view on where copper demand comes from - at least in terms of industry/products. Now lets take a look at copper demand by nation - and more importantly, copper production by nation.

Part 5: The Where (Who needs it and who’s got it)

No surprise here, like basically every other raw material, China is currently consuming the most of it. As they’ve rapidly expanded their energy production capacity as well as pumped trillions into housing and manufacturing, Copper has become a critical choke point for China. They need copper - roughly 15.5 million metric tons of it annually (about $200 billion USD).

Next we can look at where all this copper is coming from (hover on countries for more detail):

The story should be fairly clear by now how very concentrated both copper demand and production is across the world. Chile, Peru, and the DRC collectively produce about half of global copper. Moreover, China doesn’t produce nearly as much as it consumes, and neither does India for that matter. Instead, large nations like these must import one of their most critical resources.

Take a look at this next chart and maybe you can figure out whats missing.

How can the world consume ~4 million tons (not pounds) more copper than it produces?

Part 6: Recycling

One of copper’s most incredible properties that I didn’t mention earlier has to do with its ability to be used and re-used over and over and over again. Copper (thank god) doesn’t rust away or lose its conductive abilities. Unlike steel which does weaken somewhat with re-use, Copper can theoretically be recycled indefinitely. When copper is refined from rock-form into a usable sheet of metal it is called a “cathode.” And a recycled cathode is just as good as a virgin one - so long as the recycling process was done correctly and didn’t introduce too many impurities.

And so that ~4 million ton shortage in 2024 is just about equal to the amount of copper that was recycled that year (~4.5 million tons).

So, where is all this scrap coming from?

Why the color distinction? Well, scrap copper is either “new scrap” or “old scrap.” New scrap refers to the “extra” copper which is left over after some product/pipe/wire/ect has been produced. This stuff is shipped right back to the refiner to be re-melted into a usable cathode (sheet). Then there’s “old scrap” which is probably what you imagine when you think of copper recycling. This is the stuff pulled from junk yards and demolition jobs and the like, and required a good bit more care and attention on its way back into the system. Old scrap usually moves more or less in line with copper prices. Imagine if you suddenly got 25 cents back for your recycled bottle instead of 5 cents - odds are you might immediately go around looking for more bottles, or simply go and try to capitalize on the price move. You may even go dumpster diving for some easy cash. Point only being that while bottle rebates are usually stable and set by the government, copper prices are nothing like that. The price of copper has more than doubled since 2020 (and before that as well).

Now, I mentioned earlier that copper can theoretically be used and re-used over and over - and for “new scrap” that is absolutely true. You can melt, smash, form, reform, use, and repeat over and over indefinitely with a piece of copper. That said, when it comes to “old scrap” a.k.a “end of life” copper, about 40-50% of that is essentially lost each year - as in, its simply not economical to recover it. The rate varies depending on whether we’re talking about building/construction or consumer electronics. It might be easy to pull a lot of copper out of a demolished building and make a great profit. If I wanted to try and get a half pound out of an old laptop - on the other hand - its maybe not such a worthwhile endeavor.

Part 7: Basics of Copper Mining/Production

Ok, I think its time we get a little dirty and talk mining. Some of this will be general mining concepts, and some will be copper specific. Firstly, lets talk types of mines:

Open Pit vs Underground

Copper ore is extracted from the ground in two ways – open-pit mining and underground mining. Open-pit mines are large excavations on the surface (essentially giant pits), whereas underground mines involve tunneling below the surface to reach deeper ore bodies. In today’s copper industry, open-pit mining is way more common. The vast majority of copper comes from open-pit operations – roughly 80% (open-pit) versus 20% (underground).

Why So Many Open Pits? Well, the choice of mining method mainly comes down to the deposit’s depth, size, and economics. Open-pit mining is usually favored when copper deposits are near the surface or spread over a large area. It’s generally more cost-effective on a per-ton basis because you can use big trucks and shovels to move large volumes of ore and waste rock. This scalability and efficiency make open pits ideal for low-grade (we’ll talk grade in a little bit), bulk-tonnage deposits. By contrast, underground mining is chosen if the copper ore is located deep below ground or in steep/complex geology where an open pit isn’t feasible. Underground methods are more labor and cost-intensive (you have to dig shafts, build tunnels, and bring ore up to the surface), so they’re typically reserved for higher-grade or deeper deposits. Underground mining is also generally considered more environmentally friendly.

In short: open pits dominate because much of the Earth’s copper ore is relatively near the surface, and in large/low-grade ore bodies that can be efficiently mined in bulk. Underground mines fill the niche of accessing ore that open pits can’t reach – for example, when the deposit continues at depth below an open pit, or in areas where an open pit would require removing too much waste rock.

Those massive mines in Chile and Peru (some are about 2.7 miles wide and 650 ft deep) are all open pit mines.

Ore Grade: How Much Copper is in the Rocks

When it comes to copper mining, the “grade” is usually expressed as a percentage. Most copper mines have a “reserve grade” of 1% - meaning for every 1 tonne of rock in that mine, there is about 10 kilograms of copper. If you walked into the mine and took a shovel full of rocks and dirt, about 1% of that shovel-full should theoretically be copper.

There’s another type of mining grade called “head grade” which represents the amount of copper present in the ore that actually goes to the mill. I like to think of “reserve grade” as a sort of once a year blood pressure check-up at the doctor, and “head-grade” as the reading you’d get from a smart-watch; it could be a bit higher or lower than the reserve grade reading.

You’ll often hear both “head grade” (the grade of ore fed into the mill) and “reserve grade” (the average grade of the ore remaining in the ground in the reserves). Head grade can fluctuate as a mine operator blends richer and leaner ore to achieve a target feed. Over a mine’s life, head grades often decline as the highest-grade sections are mined first. This is why mining companies keep an eye on ore grade trends – declining grades can squeeze margins unless offset by higher throughput or technological improvements.

This took me a minute to get my head around, so i’m probably over explaining it. But basically, before I go build a copper mine I have to take a look at the rocks and see if there is enough copper in the rocks to make a profit when I mine it - usually this is about 1%. Thats the “reserve grade.” Then I get my mine up and running and start shipping copper ore to the mill. I probably start off with the parts of my mine that have more copper in the rocks (higher reserve grade), and then as the years pass I start having to mine to the “shittier” rocks (less copper in them). So this realtime shift in “grade” is being measured by the mill and thats gonna be my “head grade.” In the early days it can be a few tenths of a percent higher or lower than that reserve grade, but over time its common for head-grades to decline to about 0.5-0.7% or so.

I explained it to death because now we’re gonna get into recovery.

Recovery

So we’ve gotten our rocks and now we have to get the copper out of the rocks. The amount of copper we can actually extract from those rocks is going to give us our recovery rate. Naturally, just because there is 10 kilos of copper in 1 tonne of rock doesn’t mean i’m actually gonna get the whole 10 kilos. Probably more like 9 kilos actually - although it could also be a bit higher (10.5kg-11kg).

The type of recovery method depends first on the type of ore (copper bearing rock) you have. There are basically two types: “Sulfide Ore” and “Oxide Ore.” And the practical difference between those two is whether the ore floats or not. So why is float-ability important? Because the highest recovery rates for copper mining come from a process called….

“Flotation”

Ok, so you got your big rocks which contain some copper and you want to start getting the copper out of the rocks. With flotation, first you crush and grind the rocks into powder and mix it with water (a muddy soup called “slurry”). You add tiny amounts of soap‑like chemicals (called “reagents” or “collector”/"frother”) that make the copper‑bearing bits act like they’re oily. Then you blow air through the soup. The copper‑bearing bits stick to the bubbles and float to the top; the ordinary rock bits sink. You skim off the bubbly froth and that’s your copper concentrate (usually 25-30% pure copper). What sank is the waste (called “tailings”).

This is the essence of “flotation” and it can produce yields (recovery rate of copper metal) anywhere from 80-90%. It usually involves some refining and tweaking by mill operators to get the highest yields possible. To quickly clarify, this “recovery rate” refers to the amount of copper metal that was in those rocks being recovered. The “concentrate” is still only 25-30% copper metal and thats whats being sold to the smelter.

And remember, this only works if your copper ore is “Sulfide Ore.” Because there is another type of ore (Oxide ore) that doesn’t float so good.

Leaching

Ok so the first step in leaching is the same as flotation: crush the rock.

Next, you place that crushed rock in a big shallow pile (called a heap) on a sort of lined pad. Why a lined pad? Well, because you’re about to dissolve the copper in a liquid and drain it into a sort of pond. Basically, you drip dilute sulfuric acid over the heap. The acid then dissolves the copper out of the rock, making a green-ish liquid called pregnant leach solution (PLS).

Then, you mix that liquid with a special organic “copper‑grabber” (solvent extraction). It pulls copper out of the PLS and leaves most impurities behind. Then you strip the copper back into a small, clean acid solution.

Finally we have a process called “electrowinning.” This process involves placing plates of metal into the copper rich liquid, and applying an electric current in order to extract the copper. Without going super deep into this, the basic idea is that this setup will attract the copper ions to the metal plate which has a negative charge; forming a sheet of copper over a few days. This sheet of copper can be peeled off and sold as a pure copper cathode. No smelter required.

(electrowinning is a really cool process that i’ve heavily simplified, but it does require some pre-existing knowledge to fully wrap your head around. If you understand some basic chemistry and electro-physics, its worth reading up on for fun)

While this “leaching” process for oxide ore doesn’t produce as high a recovery yield as flotation for sulfide ore does, it is a bit less capital intensive and obviously doesn’t require a smelter. Its just a bit wasteful honestly, so probably doesn’t result in the greatest long-term mine economics.

Roughly 80% of copper ore is sulfide ore and is recovered through flotation. The remaining ~20% is oxide ore that is recovered through leaching. If you’re mining oxide ore and using leaching to refine it then you’re done when you ship those copper plates off to whoever bought them.

If, however, you’re using flotation (80% of copper is recovered this way), then you’re gonna be selling to a smelter.

Smelters

Remember that copper-rich goop that we scraped off the top of our bubbly flotation pool? Well that “copper concentrate” will be sold to a smelter who will then turn it into a pure-copper sheet (cathode) that can be sold to..well… whoever needs copper.

Lets first talk a bit about smelting so we can better understand how business is done between miners and smelters.

Upon arriving at the smelter, the copper concentrate (called filter cake) is quite wet 8-10% of the weight is pure moisture. The filter cake is first sampled and assayed so both sides agree on what’s in it (copper grade, moisture, any gold/silver, and impurities). The damp powder is then dried and blended to suit the furnace.

In the smelting furnace (think giant, very hot kiln), the sulfide concentrate melts with a bit of silica “flux.” The iron in the feed bonds with the silica to make a glassy slag that’s skimmed off, the sulfur burns to SO₂ (captured and turned into sulfuric acid in an acid plant), and the copper collects in a molten layer called “matte” - which is usually about 60–70% pure copper.

That matte is poured into a converter, where air or oxygen is blown through it to burn out the last of the sulfur and iron. What’s left is “blister” copper - about 98–99% pure. The blister is quickly “fire‑refined” for fine control of chemistry and cast into thick plates called anodes.

Those anodes go to “electrorefining” (a process somewhat similar in theory to the “electrowinning” process used for oxide ore (minus the dissolving part). The result is shiny, salmon‑colored cathodes that are 99.99% copper.

Meanwhile, tiny amounts of precious metals and other elements fall off the anodes as slimes, which are refined separately for gold, silver, selenium, tellurium - all quite valuable byproducts. Slag is re‑cleaned to recover any trapped copper before disposal or sale, and the sulfuric acid made from the off‑gas is often sold to nearby mines or fertilizer plants.

The smelter then sells the cathodes to wire‑rod, tube, and sheet mills. Typically, the smelter will sell the copper cathodes at LME price (whatever the current copper price/lb is) plus a little premium.

Smelter/Miner contracts

Ok, so now that we understand smelting, lets talk about how business is actually done between miners and smelters.

When a shipment of concentrate reaches a smelter, both sides test it to agree on how much copper it really contains. The smelter then pays the miner based on the market copper price (LME) for that period (times the agreed amount of copper in the shipment).

From that, the smelter subtracts its processing fee (the cost to turn concentrate into metal). If the concentrate also contains a bit of gold or silver, the miner gets extra credit; if it contains too much of a problem element (like arsenic), there’s an extra deduction.

Because testing and final pricing take time, the smelter usually sends a large upfront payment when the ship leaves or arrives, and then trues it up after the final numbers are known. Contracts also spell out practical things like who pays for shipping and when ownership changes hands.

That’s it: value of the copper, minus processing costs, plus/minus a few adjustments.

Here’s an example to help clarify:

-First: 10,000 tonnes of concentrate arrive at the smelter.

-It’s 10% moisture, so 9,000 dry tonnes.

-Lab test shows 25% copper in the dry tonnes = 2,250 tonnes of copper contained.

-Contracts usually pay for “payable” copper (most, but not all of the contained metal).

Say this deal pays 96.5% of contained copper = 2,171 t payable Cu (copper).

-Lets say the LME (London Metal Exchange) has copper at $9,000/tonne.

-Gross value before fees = 2,171 t × $9,000 = $19,539,000

-Then we adjust for processing fees, impurities, and precious metals

-First: Processing fees (usually a flat fee/tonne - “treatment charge” - and a small fee per pound - “refining charge”)

-For the Flat fee (treatment charge) lets assume $80/t: 9,000 t × $80 = -$720,000 fee

-And for the per/lb fee lets say $0.085/lb: (2,171 t ≈ 4.786 million lb) = -$406,800 fee

-Total processing fees for our 9,000 tons (worth $19,539,000) = -$1,126,800 (about 5% of the gross)

-So net smelter fees we have: $18,412,200

-Then lets add freight fees (-$300,000), impurity fees (-$100,000), and credit from gold/silver by-products (+$250,000)

-And you end up with about $18.26 million paid to the miner (still only about 5 or 6 percent of the payable metal value that was present in the concentrate).

Not bad. So lets actually talk about these miners.

Part 8: Big Boys - The Major Copper Miners

Ok, you know most copper is coming out of Chile, Peru, and the DRC. That doesn’t mean the mines are owned by those nations (or companies within those nations). As you might imagine, miners don’t usually discover copper underneath their headquarters. Most mines (in general) are built on someone else’s land, and the mining company pays that owner (be it a company, an individual, or a government) a royalty on what the mine produces. All this to say that land owners and mine operators are rarely the same entity. Moreover, its often the case that multiple mining companies share ownership of a given mine.

So here I want to break down the actual miners a bit, and give you a general overview of who controls the market. Below is a table displaying the largest 10 copper mining companies in the world - ranked by annual copper production. I’ve also included the market cap of each company as well as the percentage of revenue that actually comes from copper. These companies collectively control about half of all the copper production on Earth.

As I mentioned earlier, its often the case that a copper mine is owned by multiple companies (or governments), and so below I’ve made you a map of the top 25 largest copper mines on the planet. The mines on this map represent half of global copper production. The rest is made up of ~150–200 mid‑tier and smaller mines worldwide. I’ll also mention that some of the mines are “polymetallic” (they produce more than just copper), but those mines produce so much copper that they’ve made the list. Feel free to hover over the map to get more info on each mine.

Part 9: Copper Today (why the spike in price?)

If you hadn’t noticed, copper prices have been soaring - especially since the U.S recently announced a 50% tariff on all copper imports. But even before that tariff, Dr. Copper was ripping upwards in price. So whats going on?

Well, the short version is simply that supply is “tight” and a serious demand narrative is taking shape.

Copper’s rally starts with scarcity. Mines haven’t added enough new supply, and the ore that feeds smelters has been tight, so the fees smelters charge (a good stress‑gauge) plunged. On top of that, a few big disruptions knocked out meaningful tonnage, while drought and power issues in parts of Africa made operations less reliable. With less metal around, visible inventories thinned, and prices began climbing.

And then the demand story took hold.

I’m not sure if you’re familiar with the term “electrification,” but its one of the major trends that seems like an unavoidable force pushing the price of copper upwards. EV’s require about 4x the copper needed to make a traditional auto, and moreover they require a lot more power transmission infrastructure for viability. If we can’t charge EV’s when we need to…why would we buy them.

Moreover, we need new power infrastructure (grid) regardless of EV’s and electrification. The world needs more power than ever before. Massive AI data centers and just general economic development doesn’t mean less power. It means MORE MORE MORE. More energy generation (which requires copper), more energy transmission (also more copper), and more energy consumption (tough to consume electricity without copper).

This shift to electrification doesn’t require you to agree that climate change is an existential threat. I think that, but frankly theres another idea I basically agree with whole heartedly: WE ARE WASTING OIL AND COAL.

Fossil fuels aren’t going anywhere anytime soon. We need them for all sorts of things, primarily feedstock, fertilizer, and concrete production. Transitioning to nuclear energy, for example, saves us from wasting precious fossil fuel resources on something as silly as electric light and transportation. We could “easily” provide that electricity from other sources.

I won’t go into a whole thing on grid stability right now (since i’m already on a tangent), but suffice it to say the world is going to need more power in 50 years - not less. And its going to need that power in more places as well.

All of this. ALL OF THIS requires copper - and more copper than before.

If you scroll back to the table that shows how much copper is needed for various things (a mile of transmission, a nuclear plant, an iphone, ect), you’ll see that renewable energy and “clean energy” always ends up needing more copper per Gigawatt than coal or gas fired power plants.

But we saw that coming right? I mean surely the U.S has copper mines about to break dirt any day now right? Wrong.

One U.S copper mine is slated to come online in the next 5 years.

One.

Why so few? Well, in short, its a pain in the ass.

A large greenfield copper mine typically needs close to a decade (often longer) to move from discovery to commercial production. That clock is filled with baseline studies, complex permits across multiple agencies, community consultation, indigenous consent, water rights, power interconnects, and frequent legal challenges. Even after permits, designs get revised for tailings safety, water stewardship, and biodiversity standards, which adds years and capital. In short: its a marathon, not a sprint.

Second, the geology and engineering are tougher than they used to be. Average ore grades have been drifting lower, deposits are deeper and more remote, and strip ratios are higher (you move more rock for the same copper). That means more capex, longer construction schedules, and more things that can slip.

Costs have also been sticky. Labor, steel, explosives, power, and long‑lead equipment are all inflated in price.

Finally, where the copper is brings its own risks. A lot of future supply sits in jurisdictions with shifting taxes/royalties, currency controls, or periodic export restrictions. Power and water can be scarce (or carbon‑intensive), and grids/droughts can curtail output. ESG expectations keep rising, and any misstep can halt a project mid‑stream. That’s why companies often favor brownfield expansions, “debottlenecking,” leaching add‑ons, and mine‑life extensions over brand‑new “megaprojects.”

Recycling will grow and help - but it doesn’t replace new mine supply at today’s demand trajectory. Put together, these frictions explain why copper can surge for months while “new supply” remains years away.

TL;DR: we’re short on copper.

Part 10: Thoughts

Ok look, i’m not an expert in minerals and mining, but I am invested in copper…. I can’t exactly tell you how, but suffice it to say that my “secret position” (paid subs only) is directly related to copper (at least for a while).

I know, very cryptic. For me, the important thing is to get my head around these terms and the story in general. Lots of folks will tell you how to invest in copper - you don’t need me for that. I’ve had Southern Copper on my watch-list for a while, since I am somewhat interested in this trend of the U.S re-shoring its critical mineral supplies (of which copper is a big one). I personally believe that this is more bi-partisan than some people think. After all, ya can’t do very much without access to copper. I never took that plunge into Southern Copper simply because analyzing mining companies is not my specialty…with the exception of coal I guess (but hey thats different).

What mattered to me was understanding how all this works and trying to fully wrap my mind around why copper will be so crucial over the next decade or more. I needed to know why it was unlikely copper would get cheap and stay cheap - thats all I really cared about.

My hope in writing this was to give you a strong base of information and understanding in the world of copper. Do with it what you will.

Peace

-MoS

Have some thoughts of your own? Drop a comment and lets talk about it.

Disclaimer: Not investment advice. This publication is for education and entertainment only. Nothing here is an offer, solicitation, or recommendation to buy or sell any security. I may own (or short) securities mentioned and may change positions at any time without notice. Investing involves risk, including loss of principal. Do your own research and consider speaking with a licensed adviser who knows your situation.

Very interesting! Pitty I can’t (indirectly) ride this wave too due to my buy-restrictions..

Absolutely wonderful; Thank you.