Look, I love Warren Buffett. His words and career make up the foundation on my entire investment philosophy, and honestly I regard him as a sort of mentor. That said, I don’t go out any buy whatever Berkshire is buying. As I write this, I still don’t own shares of Pool Corporation, but the market hasn’t yet opened for the day, so that could all change by the closing bell.

While I may not blindly copy great investors like Warren, I do find it helpful to try and understand their positions. In doing so I can usually learn something, and occasionally I agree so much with what I believe to be their thesis that I actually do go and buy the thing. Thats what happened with AMR/HCC and it may be happening today with Pool Corporation. This company is quite boring and unexceptional at a glance, but as I began to dive deeper I started getting that little tingly feeling I experience when I find something I both understand and like.

Pool Corp ($POOL) is a capital-light, moat-y compounder with some short-term headwinds and long-term tailwinds. Their business model is solid and their dominant market position remains undisputed. Capital returns, steady growth, and a strong balance sheet all equal the sort of company an investor like me would want to own for the long run. Alright, lets dive in (wink).

Part 1: The Business

I never had a pool growing up. My Dad always said it was better to have a friend with a pool than to own one personally. The reason of course was the high maintenance costs of actually owning a pool. Now, plenty of that has to do with the energy costs of heating the dang thing, but you also need chemicals, cleanings, filters, lining repairs, and all sorts of other products and services to maintain your pool. You could try and do all this yourself? But most people get a pool guy…and the pool guy shops at Pool Corporation.

Pool Corp. ($POOL) is the world’s largest wholesale distributor of swimming pool supplies, equipment, and other related outdoor leisure type products. Its sort of like the Home Depot for pool supplies, except usually its customers are smaller pool installation/maintenance companies (the pool guy). It operates a “hub-and-spoke” type distribution model; purchasing a broad range of products from many manufacturers and delivering them to over 400 regional sales centers for resale to local pool builders, retail stores, service companies, and contractors. Most of this market is highly fragmented in the U.S, but Pool Corp acts as a sort of central “hub” around which the “spokes” of the pool market spin. This model allows smaller pool businesses to obtain supplies more efficiently - and on better terms - than they could on their own.

$POOL has grown from a small regional player into a multi-national, multi-network distributor. Over the last decade they have steadily expanded their business both organically and through careful acquisitions. The fragmented nature of the market opens the door for Pool Corp to buy up small competitors at good prices and maintain their competitive position. In fact, these guys don’t seem to really face any large-scale competitors. They have gotten way out ahead of anyone else in this market and don’t appear to be slowing down.

Back in 2013, the company operated 321 sales centers. Since then, that number has risen to 398 by 2020 and 448 by 2024 through acquisitions and organic greenfield additions. As of 2024, POOL’s network spans North America, Europe, and Australia, organized under four main distribution brands: SCP Distributors, Superior Pool Products, Horizon Distributors, and National Pool Tile. I should say, these guys mostly operate in the States, but I do like to see that they have a growing international presence.

So what do they sell? Well….pretty much anything you could possibly need if you have a pool. Their catalog includes essential maintenance chemicals such as chlorine, bromine, algaecides, pH balancers, and testing kits - all products that pool owners need on a recurring basis. In fact, Pool Corp’s management estimates about 65% of their revenue comes from recurring sales of these “maintenance” items.

They also sell a wide array of equipment, including pumps, filters, heaters, heat pumps, pool automation systems, robotic cleaners, lights, and covers. For new construction and renovations, Pool Corp supplies materials like tile, interior finishes (plaster, quartz, pebble), decking, coping, and plumbing components. They carry a full selection of repair and replacement parts (from motors and cartridges to seals and valves). And of course they sell cleaning tools like nets, brushes, skimmers, and service gear.

While their primary business involves pool supplies, Pool Corp has been expanding into the “backyard living” market - offering products such as patio furniture, outdoor kitchens, grills, fire pits, water features, and shade structures.

Moreover, through its Horizon brand, Pool Corp also distributes landscaping and irrigation supplies. This segment includes sprinklers, controllers, turf chemicals, lighting, drainage, and professional landscaping equipment. Many of these products are available under proprietary or exclusive brands; further reinforcing Pool Corp’s position as a one-stop distributor for pool and outdoor professionals. I should also mention that much of this segment is also recurring in nature.

Below is a visual breakdown of Pool Corp’s business segments and their estimated revenue contributions. The green segments are primarily recurring revenue sources (e.g maintenance chemicals and equipment parts), while the grey segments are more discretionary or “one-time” purchases (like construction materials and decorative finishes). This should give you a nice birds eye view of how they make their money, and how much of it tends to come back year after year.

Ok so, thats what they do. But how do they do it?

Part 2: Business Dynamics: How does this business work?

Ok lets break this down part by part, starting with the manufacturers.

Pool Corp buys tens of thousands of SKU’s (individual products) from hundreds of different manufactures (think chemical companies, hardware companies, and even tile/flooring/decking companies for new builds). They buy these in bulk from the manufacturers which allows them to leverage their scale and negotiate better prices. The lower prices give them some leeway down the road and the sheer volume they order gives them massive sway with their suppliers. Just like Costco can call the shots with their cereal supplier, so can Pool Corp with their chlorine supplier.

Next comes distribution. After Pool Corp has purchased a boat load of products, those items move to the distribution network. Pool Corp operates over 448 sales centers across North America, Europe, and Australia. ***Important note: These are regional warehouses (not stores)*** Each warehouse location carries a deep inventory tailored to the local climate, pool styles, and contractor preferences. The network is managed centrally but operates close to the customer. Pool Corp receives their products from the suppliers, stores those products in their warehouses, and then those products are eventually shipped (or picked up) by the customer (contractors, service professionals, retail pool stores).

The customers are pool builders, service techs, and retail stores. They either order online or work with inside sales reps at the Pool Corp warehouse. Orders can be delivered to a job site or picked up directly.

Pool Corp “adds value” to the system in a few different ways. First and foremost they they aggregate supply. Most builders can’t order directly from 15 different manufacturers, so Pool Corp bundles it all into a package that suits the needs of that customer. Moreover, Pool Corp’s warehouses are able to hold inventory locally. This keeps thousands of parts and materials stored close to the job sites - that way pros don’t have to waste time and wait weeks for orders to be shipped from far away. They run a sophisticated logistics network which enables just-in-time delivery to job sites. They also offer credit which is a big plus for small contractors. And finally they offer sales support which can help contractors spec projects, order materials, and schedule deliveries.

Its a one stop shop for anyone in the Pool business. Sure, its a “middle man,” but its the only middle man around. Unless your pool boy can afford to order all of his chemicals, parts, and equipment directly from the hundreds of manufacturers that sell them (in bulk I should add)… then I doubt Pool Corp will have trouble holding its market position.

Here’s another diagram for you depicting the overall market flow (you may have to zoom in on this one):

Part 3: The Moat

Now that you understand Pool Corp’s role in the Pool market, we should probably break down the various qualities that give Pool Corp its moat. I should say that this isn’t necessarily the most epic moat in history, but it is a moat. Pool Corp doesn’t really have competitors besides maybe your Dad trying to chlorinate his own pool and buying the stuff on Amazon. But realistically, pool maintenance is actually somewhat labor, time, and skill intensive. Most people who can afford a house - let alone a pool - don’t really want to expend the effort required to properly maintain the thing. Everyone I’ve ever known who owned a pool had a person who came once a week or once a month to maintain it. Moreover, the pools in gyms and hotels legally must meet certain upkeep requirements, so theres not much wiggle room from DIY in the commercial pool sector.

Lets break it down:

Scale Purchasing: “Bigger buyers get better deals.”

Pool Corp’s sheer volume lets it command pricing, priority, and selection that others can’t match. The companies enormous purchasing volume across thousands of SKUs gives it significant leverage with its suppliers. As the largest pool and outdoor-living distributor in the world, they can (and do) negotiate better prices, secure early access to new products, and often receive volume rebates or better payment terms. This scale also means they can afford to carry a much broader product mix than smaller competitors, thus enabling contractors to source everything from chlorine tablets to robotic cleaners in one place. And for the manufacturers Pool Corp is a darling. It represents a reliable, high-volume customer with low distribution risk - so suppliers are often willing to offer exclusive products or co-branded partnerships. The result is that Pool Corp can offer its customers more choice, better availability, and (usually) better prices than local competitors can.

Distribution Density: “Always nearby and always ready.”

With hundreds of locations, Pool Corp is never far from the job site. They operate over 440 strategically located sales centers across North America, Europe, and Australia; thus enabling Pool Corp to stay within close reach of its professional customer base. This physical density means faster delivery times, more reliable stocking of products, and lower transportation costs per unit. Most pool contractors operate on tight schedules and can’t wait a week for a pump to arrive. They need it tomorrow! Pool Corp’s local presence ensures those needs are met. It also gives them geographic redundancy - as in - if one location runs out of stock, they have another nearby warehouse that can step in. Their logistical footprint isn’t just large, it’s also optimized for proximity and seasonality; giving them a huge service advantage over less dense competitors or ecommerce alternatives.

Operational Efficiency: “Faster, cheaper, smarter.”

Decades of investment in systems and scale mean Pool Corp wins on cost and execution. The company continuously invests in making its operations more efficient by optimizing everything from warehouse layouts and inventory turnover to delivery route planning and online order fulfillment. Their scale allows for technology upgrades (think predictive inventory systems and realtime delivery tracking) that smaller rivals simply can’t afford. This translates into lower fulfillment costs, fewer “stockouts” (being out of stock), and higher asset productivity. Importantly, these operational efficiencies allow Pool Corp to preserve (and expand) margins even when gross margins are under pressure, giving them a structural cost advantage. While anyone can theoretically distribute pool supplies, very few can do it this efficiently.

Customer Loyalty: “Hard to put a price on trust”

Contractors stick with what’s reliable. Pool Corp’s credit, service, and convenience keep them close. Pool Corp’s customer base consists mainly of small to medium sized pool contractors, retailers, and service technicians - most of whom are short on time and cash. Pool Corp offers these customers not just product access, but credit terms, technical guidance, personalized service, and dependable delivery. Over time, this builds loyalty among their customers. A contractor who consistently gets what they need from a local Pool Corp rep is unlikely to shop around unless something goes seriously wrong.

Proprietary Products: “You can’t get it anywhere else.”

One of Pool Corp’s more under-appreciated advantages is its control over proprietary brands - most notably the NPT (National Pool Tile) line. These products (tiles, finishes, and decking materials) are developed and distributed exclusively through Pool Corp’s network. This creates both brand preference and a structural lock-in. Once a customer chooses an NPT finish or tile style, they generally need to continue sourcing it from Pool to match the original install. Proprietary and private-label goods also carry higher margins and reduce price competition, because customers can’t easily compare them to products from other distributors. As NPT and other private labels expand, they create a competitive moat within Pool Corp’s product mix - giving the company more control over pricing, inventory, and branding.

In short, Pool Corp is imbedded into the pool world. Not only do they face no competition at scale, but it would be very costly and very difficult to disrupt their competitive positioning. This isn’t a software company that can be rendered obsolete in a year. Nor is it a retailer being choked by Amazon. The recurring nature of much of their business, as well as the competitive advantages gained over time with scale and efficiency make Pool Corp a long term winner in my eyes. AI might change a lot, but its probably not going to make people stop using their pool.

Part 4: The Numbers

Alright, I think we’ve covered the business itself by now. But lets take a look at their financial performance.

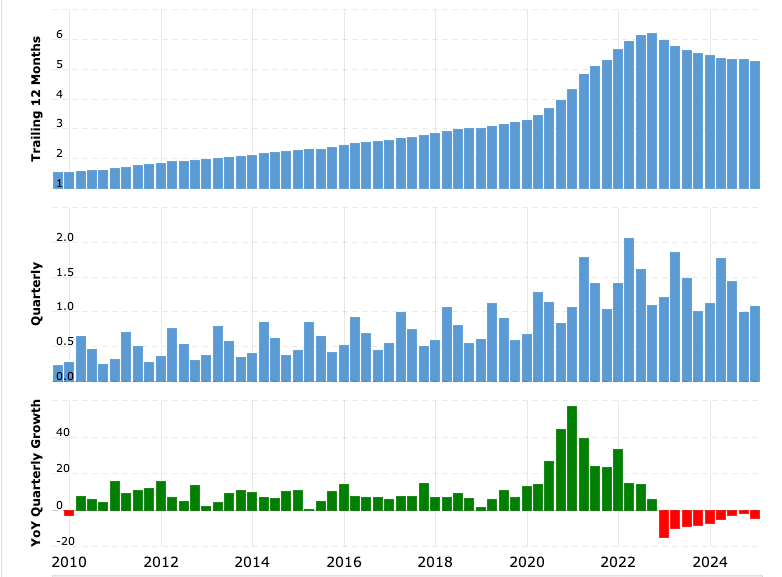

Below you can see $POOL’s revenue going back to 2010. You’ll notice a sharp increase during covid and a steady decline thereafter. We will get into that a bit more as we go, but suffice it to say Pool Corp had a massive pull-forward in orders (as well as new pool constructions) during the pandemic. People were stuck at home and apparently a bunch of them decided to build a pool. Perhaps more significantly, many folks were worried they wouldn’t be able to get the products they needed to maintain their existing pools. All of this resulted in customers ordering years worth of chlorine and the like in a very short period of time.

Next we can take a look at Net Income. As you can see, Pool Corp has maintained steady profits which follow the same “pull forward” path as their revenue. Perhaps you’ve noticed the sharper increases and decreases in Net Income vs Revenue. This is due to the congruent increase in margins along with revenue during the covid “pool boom” as well as the subsequent normalization of both top line and margins.

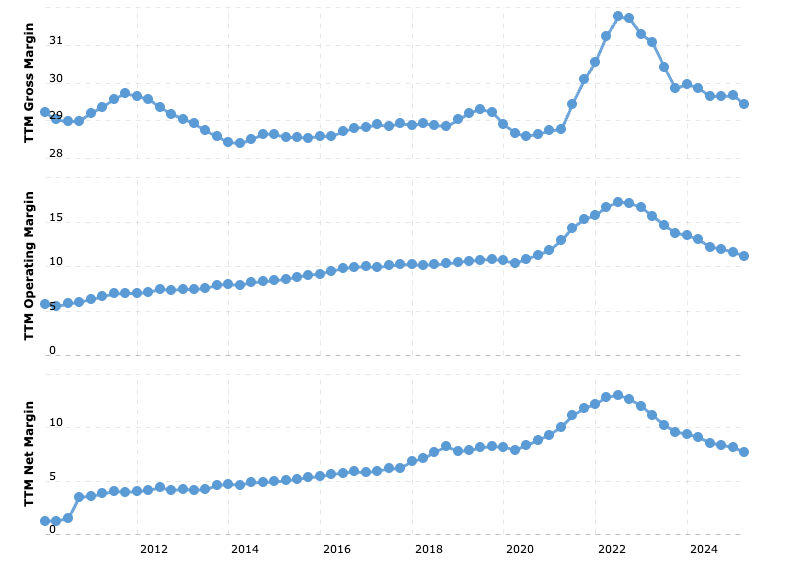

Speaking of margins, below you can see Pool Corp’s Gross, Operating, and Net Margin. The margins are hardly the selling point, but you’ll notice the steady increase in operating margins from 2010 to 2020. Over the decade, Pool Corp’s operating leverage enabled it to double both its operating and and its net margins as a result. You’ll also see the large boost to their margins during the “Pool Boom” and of course the subsequent “hangover” normalization.

But what about operating efficiency? Is this business capital efficient? Well, below you’ll see Pool Corps Return on Equity which sits at a very healthy ~30% - well within my definition of a “quality” business.

Realistically, however, the ROE is higher than the 30% we see today. As previously mentioned, Net Income has fallen as a result of the post-boom normalization, but thats only half the story. Shareholder equity rose sharply over the past few years. This sharp increase in equity raised my eyebrows at first since I do not like business’s that have to deploy a ton of my capital to earn a profit. Fortunately, upon further digging I found the cause of this increase in equity.

First, I noticed that retained earnings had spiked after the post covid boom. This made sense to me since they earned so much cash during that period. Some of the cash was returned to shareholders in the form of buybacks and dividends, but the rest was retained in the business. I checked cash-on-hand as well as the property and equipment, but saw to increase there. And finally I found it: inventory! Ah ha! So Pool Corp has essentially gotten way ahead of any tariffs or inflation with their excess cash, and simply bought up a bunch of inventory. Luckily, pool-supplies don’t really “go bad,” so this inventory will be sold eventually, and that large increase in inventory will begin converting back to earnings - thereby pushing ROE back to its proper place (~50/60% or so). Phew.

Below you can see the inventory increase i’m talking about:

As I hinted to earlier, Pool Corp buys back its shares and pays a modest ~1.5% dividend. Below you can see the dividend growing over time as the share count decreases.

On to the balance sheet. Pool Corp’s debt is very manageable at less than 3 years of normal net income (not the covid boom levels).

Moreover, the business requires very little capex to operate. In 2023 for example, Pool Corp spent only 37.5 million on Capex and earned a whopping $659 million in operating cash-flow. It should also be noted that their FCF can sometimes stray quite far from their net income for a period of time. This difference is mostly accounted for by the timing of working capital and inventory cycles - more of a feature than a bug. In 2023, for example, Pool Corp was able to earn a ton of cash on existing Covid-era inventory while Net Income declined. Below you can see a chart depicting FCF vs Net-Income.

Here is a chart depicting Net-Income vs FCF over time:

And if you want to take a look at Capex vs Net-Income vs FCF see this table below:

Over 10 years their CAGR for EPS ends up at ~15.5%. This is while paying a modest but still relevant dividend.

Ok, so the numbers check out (to me anyway). What about the business landscape?

Part 5: The Pool Market

As you’d probably guess, new pool construction is largely tied to new home construction and overall housing activity. While 65% of their revenue comes from recurring maintenance of existing pools, most of the growth of the business comes from growth in the housing market. If you hadn’t noticed, the U.S is facing a housing shortage. Below is a chart of new privately owned U.S housing starts from the FRED:

The post-covid boost helps explain part of Pool Corps growth in that period, although management also points out that part of that boost to earnings had to do with existing homeowners making renovations and upgrades. I’m not gonna go crazy trying to prove there is a housing shortage in the U.S. The news is already full of reports of U.S housing prices being restrained by supply - the net result being prices for homes rising to somewhat unaffordable levels in many regions. The real question has more to do with when that will change. The answer is sadly I just don’t know. What I do know is that the places where the housing market (and economy) are growing fastest are all in the South - where the weather is warm and where Pool Corp gets about half of its revenue.

Florida, California, Texas and Arizona, collectively represent approximately 54% of POOL 0.00%↑ ’s 2024 net sales. In 2024, they generated about 96% of their sales in North America (including Canada and Mexico), 4% in Europe and less than 1% in Australia.

Below is a chart from the 10k which depicts the number of in-ground pools in the U.S per year:

Yet again we see the effects of covid’s pull-forward in demand for swimming pools and the subsequent “cool off” (pun intended). And just a reminder, this pull-forward wasn’t just about the new pools, it also distorts the numbers for maintenance equipment and upgrades.

On average in the U.S (going back to 2000) new residential in-ground pool construction grows at a 3-4% CAGR.

Pool Corp’s management expects most future growth to come not from building new pools, but from maintaining, upgrading, and remodeling the millions of existing pools already in the ground. They emphasize that over 60% of the industry’s spending comes from ongoing maintenance and small repairs (replacing pumps, heaters, filters, or chemicals) which are both essential and recurring. Another 20–25% of spending comes from remodeling older pools, which becomes more common as the large pool base built over the past 20–30 years begins to age and require resurfacing, equipment upgrades, or cosmetic changes. Finally, while new pool construction still matters (especially in growing southern U.S. regions), it’s a smaller and more cyclical part of the market - making up only about 15–20% of overall pool related spending.

In short, Pool Corp sees steady, long-term growth coming from the "installed base" of pools aging and needing regular care, rather than relying solely on building new ones (although that install base has and will grow over time).

In addition to pool supplies, Pool Corp also sells a wide range of landscaping, irrigation, and outdoor living products through its “Horizon Distributors” and “NPT” networks. This includes things like sprinkler systems, fertilizers, drainage solutions, hardscape materials (like stone and pavers), outdoor lighting, and even backyard kitchens and fire features. These products are often sold to landscape contractors who serve both homeowners and commercial clients. As more American’s invest in their backyard living space, this business segment is expected to drive further growth (both recurring and otherwise).

Part 6: Valuation and Current Outlook

I wish this was some super cheap and overlooked company, but its not that cheap. It currently trades near if not below its historical average TTM P/E of ~27. The current TTM Price/FCF ratio looks much cheaper at ~20. Ultimately, this isn’t the sort of “deep value” play I wrote about in my “coal bet” write up. Rather, its more like the “wonderful company at a fair price” which Buffett usually looks for these days. While he’s known for his “cigar butt” investing style, ever since he met Charlie Munger many many decades ago, Warren usually opts for companies of quality. Of course he doesn’t pay any price for them, but I think these multiples are palatable considering the ROE and the very stable business. I don’t see any reason this company won’t continue to grow at its average rate, collecting more and more recurring revenue as their install base grows and older pools get upgraded.

The free cash flow yield is currently ~5.8%, a little above what one could earn in treasuries. That said, I expect earnings to rise slightly faster than their average over the next 5 years or so. Since such a large part of the pull-forward had to do with inventory rather than just new pools being built, eventually that glut in pool supplies will drain (another pun) out of the channel. Precisely when this will happen I couldn’t say, although some have suggested 2026 would be the year of recovery as management revised its outlook for 2025 to the negative. Ultimately, a rebound in discretionary spending and new pool construction would quickly turn the tide back to positive growth.

All in all, Pool Corp’s earnings outlook has been under pressure due to sluggish new pool construction and discretionary/remodel spending. As I mentioned earlier, management has lowered guidance for 2025, expecting flat sales, with “maintenance only” growth offsetting weakness in build/remodel segments. With economic headwinds (high interest rates, delays in big-ticket projects, and softer permit activity) the company forecasts no rebound in 2025, anticipating continued margin pressure.

But signs of stabilization are emerging. Chemical sales, which reflect the recurring maintenance business, remain resilient, while private-label chemical volume actually grew 1% year-over-year in Q1. This tells me that the normalization of much of their recurring business is starting to balance.

I think its safe to expect earnings to downtrend through 2025, with a potential return to growth in 2026, especially if interest rates ease and discretionary spending rebounds. Management’s ongoing investments in digital tools (e.g POOL360), new sales centers, and proprietary products are also positioned to support recovery once demand picks back up.

Part 7: Conclusion (to buy or not to buy)

When I set out to write this, I had no intention to buy Pool Corp. At a glance, the somewhat unsexy “fair price” of ~27x earnings didn’t make my mouth water. Plus I imagined anything to do with Pools might be rather competitive and capex heavy (both of which I found to be very untrue). As i’ve learned more and more about this company, I’ve become more and more interested in it. I’m realizing that the headwinds they’re facing right now have nothing to do with execution or any overall weakness in longterm demand. Rather, whatever pressure these guys are under appears to be very short term in nature. After all, its not their fault the world was locked down and people suddenly decided they wanted a pool. In fact, that surge in demand was actually good for their business in the long run. More pools = more maintenance and upgrades.

Pool Corps stock price has come down ~50% from its highs in 2021, and today an investor can purchase shares for the same price they would have paid in 2020. There are also more pools in the U.S today than there were in 2020, and furthermore, Pool Corp has fewer shares outstanding than they did back then.

This is a well managed company in a strong position within an odd but actually surprisingly stable market. The recurring nature of 65% of their revenue is very appealing to me as it offsets the otherwise somewhat cyclical dynamics of new pool builds.

Moreover, this business is both consistently profitable and requires very little capex. Management is able to grow the top and bottom line while returning cash to shareholder via both buybacks and dividends.

In the long run I actually think this will prove to be a market beating investment. Its not very sexy, but its also not going to be run out of town by AI. Its not competing with cash-burning startups or multinational tech giants. Its just this chill little pool company, floating along and printing money.

Ps, I’ll post in the subscriber chat if/when I start building the position….more than likely its a “when.”

Great % of reoccurring revenue.