$ULTA Beauty | Why I bought it, sold it, and may end up regretting it.

A summary of my position in Ulta Beauty ($ULTA). What I loved, why I left, and why I may come crawling back one day.

I purchased my very first shares of Ulta Beauty on August 8th, 2024 for a price of $325/share. In the screenshot above you can see the proof. Why am I trying to prove this to you? Because about 1 week later it was revealed that Berkshire Hathaway had also bought Ulta for an average price of ~$400/share. Am I bragging? Definitely. But mostly I want you to believe me when I say that my decision to enter into this position had nothing to do with Buffett or Berkshire — well at least not directly.

I discovered Ulta Beauty after i’d finished reading the book “Warren Buffett and the Interpretation of Financial Statements,” by Mary Buffett & David Clark (a book I highly recommend to any active investor). Basically, I read this book and began obsessively looking for companies that fit the criteria outlined within it. Mostly, that meant looking for companies with a low pre-tax earnings yield, manageable debt, and a high ROE. Moreover I wanted a company with a “sustainable competitive advantage” that I felt I understood. Finally, I wanted a company that had a history of returning excess cash to shareholders (ideally in the form of buybacks). And man, Ulta fit the bill. I had only sort of heard of this company, but even a quick glance at valuation, margins, balance sheet, and ROE/ROA seemed to tell the story of a very solid company. Not only that, but they had been buying back a TON of shares over the last decade. Seemed to me like I was on to something.

If my mouth wasn’t watering yet, it was about to. As a male who has owned basically one razor in his life and could care less what shampoo he uses, I didn’t have much personal experience with this product market. I did, however, have one micro sized case study; my girlfriend. God bless my cheap, coupon-clipping, no-credit-card-having, budget-airline-shopping, but of course very beautiful girlfriend.

It had only been a few days since we had been out running errands, and she had brought us out of our way to some random store that sold a teeny-tiny jar of what appeared to be white goop. This white goop cost 35 euro! I was shocked because usually she is extremely cost conscious. As I stood in line I was already thinking to myself how cheap that must be to ship, and how little shelf space it takes up. I was imagining the margins on something like that thinking they must be huge! On our walk back I started prodding her for market research — as I occasionally do, and she occasionally tolerates me doing. I learned that much to my dismay, this particular company made many products and this was the only one she liked. She also explained that there are seemingly infinite brands and product lines for all this stuff; things like blush, eyeliner, moisturizer, conditioner, hand soap, face soap, nail polish, nail polish remover, mascara, lipstick, lipgloss, foundation, concealer, and something called a Kabuki brush. That is a very incomplete list by the way, but i’ll spare you the full litany. So I asked her, “how much do you spend on this stuff a month?!” and she just sort of gave me that look that says, “don’t ask stupid questions,” so I dropped it. I also dropped the whole idea of trying to find a way to invest in it — figuring the market was likely too saturated and competitive to find a winner.

Fast forward a few weeks and i’ve stumbled upon Ulta Beauty’s illustrious financial figures, and the whole conversation in the drug store comes back to me. It clicks. In a market like this, don’t buy the product, buy the retailer! So I run into the living room and I yell, “Baby! Have you ever heard of Ulta Beauty?”

“No.”

Huh. Weird. And then I remember we live in Europe, and she is European. Is it possible Ulta doesn’t operate here in Europe? Turns out Ulta Beauty only operates in the U.S.A so it makes sense she hadn’t heard of it. So I start asking her more questions about her and her friend’s buying habits around beauty products, and I come to a few conclusions:

*I’m gonna do some generalizing about women here, so yeah just be ready for that.*

Women don’t skimp on beauty.

Women don’t stop using beauty products in a recession (or global pandemic by the way)

Women enjoy shopping for and buying beauty products

Beauty is a form of self-care to many women

Women love trying out new beauty products

After my lovely girlfriend enlightened me about her and her friends’ beauty buying customs, I really started getting excited about Ulta. I’m imagining tiny jars of goop and Kabuki brushes flying off shelves to happy customers. I’m picturing discounts being given to advertise new products in stores brimming with excited eyeballs and full wallets. I’m seeing the margins, the buybacks, and the expansion. Oh god please let there be expansion! And most importantly perhaps i’m thinking about a male dominated investor pool completely under-pricing a money printing machine.

I calm down a bit and begin researching Ulta Beauty, its business model, and its competitors. Turns out Ulta beauty operates ~1,445 standalone retail locations across 50 states, as well as ~600 locations within various Target stores. They have an exceptionally strong loyalty program with 44.6 million active members (26% of the U.S female population). Those members also make up about 96% of their total sales. The focus is variety. Ulta offers a wide range of products from mass-market beauty to high-end and everything in between. They also offer in-store hair solons and something called a “brow bar” where customers can get their eyebrows done. When I bought them they were trading for a TTM pre-tax earnings yield of about 10.5%. That was a PE of about 14 (cheaper than it had ever been).

As you can see in the table above, the stock was likely cheap because net income had flattened out since mid 2022. But relative to the capital employed in the business, Ulta is getting outstanding returns with ROE in the mid 50% range. A 50% ROE, for those not familiar with the metric, is really really good…if you can keep it up.

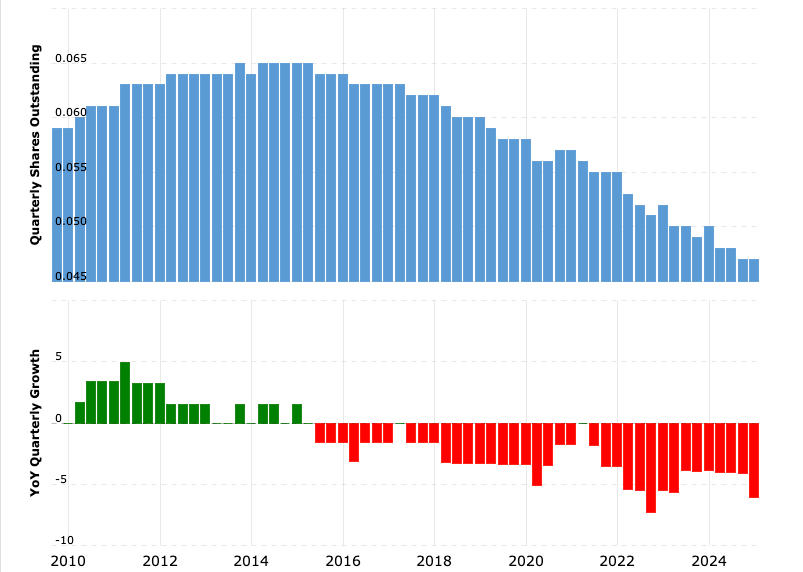

Moreover, Ulta had been buying back shares like the devil! They went from 65 million shares outstanding to 47 million in a decade.

The margins don’t look amazing at a glance ~10% net margin:

But then compare those margins (which are growing) to that of Target’s in the table below!

And finally, Ulta is doing all of this with half a billion in cash and no debt (only capital leases). Is this a retailer in 2025? Because it doesn’t look like one to me.

I figured, if they can grow revenue in the mid double digits, expand margins a bit, and keep buying back shares, I could expect an EPS growth rate close to 12-15% on an initial pre-tax yield investment of 10.5%. If they were able to expand the business into other countries then my god, the stock would be a steal at this price. It should be noted though that, at that time, nothing else I owned looked attractive. So while Ulta may not have seemed like a grand-slam, it did appear to be an easy base hit for a market beating return.

So I bought it. I bought some at ~$325, and some ~$330… and then something crazy happened….

Berkshire bought it! I couldn’t believe it. On Thursday August 14th it was announced that in Q2 Berkshire had acquired roughly $266 million of Ulta stock at an average price of $400/share. The stock jumped and continued to rally up to $404/share. I waited patiently. Realistically, this was not a large position for Berkshire. $266 mil is mere pennies for them! So I waited, the stock cooled off, and I bought more — all the while with a smug self-satisfaction that Buffett agreed with me. This was not the first time, however, that I had reveled in the comfort that Berkshire liked something I already owned, so I decided not to pay up too much for it just because it had the Oracle’s stamp of approval (who knows if it was even Warren behind the purchase).

Good thing I waiting because they sold it all the following quarter.

C’est la vie. The one plus was that, up until that point, I hadn’t acquired as large a position as I would have liked, so when Buffett sold and the stock dropped, I bought more. I built my Ulta position to ~4% of my portfolio and stopped.

So far, I’ve only told you what I liked about Ulta, but there was a reason its earnings had lagged…a few reasons actually.

Saturation, E-commerce, and moth&#@$ing Sephora

I loved everything I saw from Ulta, but there were three hurdles I could see ahead of it:

U.S market saturation. Until now, Ulta has existed entirely in the U.S. They have done a fantastic job of growing a powerful and profitable business there, but their runway in the U.S has all but run out. The expansion into Target stores was a nice boost, but ultimately there are only so many locations where you can put an Ulta store and have it succeed, and there was basically already a store in all of those places. That meant that growth would either have to come from sales volume (same store sales growth), or expansion into new geographies. Management was working on both, but my hopes lay mostly in some sort of push into Mexico. Ulta’s management has spoken a good bit about how well their “border stores” have performed, and they put that forward as evidence an expansion into the Mexican market would go well. I tended to agree here. I didn’t see any reason the people of Mexico wouldn’t love Ulta the way their neighbors to the north do. I also figured there could be expansion into South America or Europe that would prove a profitable growth path for this lean and mean beauty retailer. I’d rank this challenge as: doable

E-Commerce. The story of Amazon and other E-commerce platforms crushing brick and mortal retail is nothing new. Toys-R-Us, Radio-Shack, Sears, TheGap, Best-Buy, and lord knows how many others have been dragged into a bloody slog-fest with cheaper and more convenient online sellers. Just capitalism doing its thing I guess. But Ulta has thus far managed to keep up and actually grow its margins, expand all over the country, and return capital to shareholders in the meantime. So far so good. But theres another reason I wasn’t as terrified of e-commerce as other investors. Ulta has a palpable online presence. More and more of its sales come from its app/website, and those customers can often get same-day or next-day delivery because Ulta’s stores can double as a warehouse! Seems like someone took a page out of WallMart’s playbook. And WallMart is a great analogue to Ulta here, because so much of what they offer is variety. And with beauty products, variety is key. The other thing Ulta offers is the enjoyable experience of shopping for beauty products in-store. As I mentioned earlier, for many women the experience of going out to buy beauty supplies is a joy - not an errand. Plus its hard to try on makeup or smell a million hand creams on a smart phone. I’m not trying to claim that Amazon doesn’t eat some of Ulta’s lunch here — they totally do — but there’s still plenty left over for buybacks thanks to the unique advantages of selling something customers actually enjoy buying. I’ll rank this challenge as: limited.

Freaking Sephora is the bane of my existence. There’s nothing worse than your companies single largest competitor being owned by a parent company that doesn’t report its margins or sales or really any useful data in their annual report. Louis Vuitton (LVHM) owns Sephora, and I really wish they didn’t. If I could see Sephora’s margins I could answer this question much more easily, but I can’t…so thats just what it is I guess. Sephora is a high-end beauty retailer that directly competes with Ulta — quite ferociously I may add. Ulta beauty may have been first to implement their “store-in-store” partnership with Target, but Sephora was right behind them with Kohls. While I think Target + Ulta > Sephora + Kohls, I still don’t like the idea of Sephora’s around every corner. Reason being that while there is a notable amount of customer loyalty to Ulta (thanks to their best-in-class rewards program), a lot of this stuff still comes down to convenience. Most of the women I talked too preferred the in-store experience of Ulta to Sephora (less pushy/snobby), but told me they would probably shop at Sephora if it was closer. The lack of data on Sephora made it a black-box for me, but I had confidence that Ulta’s product variety (one that includes mass-market beauty) would give it an edge. You’ll spend less at Ulta. You can get one fancy thing and a few other cheaper, more fungible items and spend less than you would at Sephora. I rank this challenge: annoying but livable.

Ok, back to the story. Where were we? Right, I was long Ulta to the tune of 4% of my portfolio at an average price of ~$350. I bought it, Berkshire bought it, Berkshire sold it, I bought it again, and then Q2 earnings beat the pessimistic analyst expectations. I was feeling pretty good about this position I must admit. I knew it wouldn’t change my life, but I felt it was a sensible idea.

Until I went home for Thanksgiving.

I returned to my native country of the U.S.A in November of 2024 along with my new European equity analyst (a.k.a my girlfriend), and we enjoyed strolling around my usual stomping grounds and taking in the sights. Throughout the trip we made little stops into various stores (CVS, Walgreens, TJ-Max, Target, Walmart, ect). Mostly, we were were picking up small items for our new apartment on the other side of the Atlantic, but I was also doing a little investigative work for another prospect of mine, Celsius. Despite my intention to scout out cooler positioning for Celsius’s drinks, I couldn’t help but notice something about damn near every retail store or pharmacy we walked into. They ALL had beauty sections.

These weren’t small little shelves with a couple cheap lipstick brands on them; on the contrary, they were substantially large and well stocked areas — some even with special lighting — offering a surprisingly broad mix of products. The seeds of doubt had been planted in my mind, and over the course of the trip they began to germinate. Worse yet, we actually stopped into an Ulta in a strip mall, and we were both disappointed with the experience. The staff weren’t very friendly, and the layout was cramped. I had some thinking to do.

If Ulta was competing in high end beauty, E-commerce, and mass market, then I had to wonder what their competitive edge really was — and whether it was enough. Initially, I had believed in this idea of a “one-stop-shop” location for all your beauty needs, but every CVS with a mass market beauty section was likely sucking sales volumes from Ulta. If someone needs to re-up a mass-market eyeliner, and the nearest location is Ulta, they may very well end up buying one or two other items at that Ulta. But if they can pick it up when they go to collect their prescription at CVS, or a last minute birthday gift at TJ-Max, or luggage for their kids at Target….thats too convenient to pass up. My revelations about female consumer habits around beauty were crumbling.

A few days after our return from Thanksgiving, Ulta reported another beat on their Q3 earnings. The stock had reached $440/share, and I had to make a choice. Ulta had exceeded the pessimistic expectations of analysts rather quickly after my purchase. But that was just lucky. I’ve made the mistake before of attributing stock price movement as confirmation that my judgement was correct. In other words, sometimes you buy something and it goes up, but that doesn’t mean you’re right. It just feels like you’re right. The same way that being “early” and being “wrong” appear the same, being “lucky” and being “right” can look identical. Its ego that tells us we are right when we’re lucky. I’ve made that mistake before and I didn’t want to make it again.

My holding period had only been a few months, and I was absolutely beating the S&P. So I sold half my position, took my gains, and tossed them in a money market as dry powder for a new idea or a selloff. I sold the other half for a very modest (albeit market beating) gain in the middle of the Tariff tantrum after Ulta beat (yet again) on their earnings. The first half of the cash went into a nano-cap idea I stumbled upon thanks to Substack, and the second half went into buying Amazon at its tariff-induced lows.

Usually, when I sell something I don’t look back much — nor should I. But with Ulta I can’t help but wonder if i’ll regret selling. Its a great company with a loyal customer base, the balance sheet is as clean as it gets, and management doesn’t waste capital. Instead, they return excess cash to shareholders in the best possible form; buybacks. On top of that, while they are basically already at full market saturation in the U.S, there are many other nations where Ulta Beauty stores would likely be a well received alternative to Sephora or even just a smaller, more localized beauty retailer. There’s no reason I can think of that Ulta couldn’t expand into Mexico, South America, or Europe. Brazil, for example has a fast growing GDP and population. Moreover, Brazil and Argentina are second only to South Korea in plastic surgery per/capita. In my mind, a country with high rates of cosmetic surgeries would also have strong demand for beauty supplies. Its hard to let go of a well run company at a cheap price. Ulta may be slow to expand into new markets for now simply because management is moving slowly and deliberately. If international expansion were to start ticking up, Ulta’s revenue and earnings could rise, and suddenly today’s valuation would look quite cheap. I sold because I saw too many headwinds, too much competition on all fronts, and frankly I found other ideas I liked better. That said, I could see myself buying again if I had some excess cash, and the price were to return to the $325/share I initially bought it for. For me, the story is far from over for Ulta. If they could get just a bit of wind in their sails, the results could be beautiful.

Maybe then I’ll take the time to learn what a kabuki brush is.

Talk to ya later

-Peter

I think the "marketplace" pivot will be a catalyst as well.

https://www.homepagenews.com/retail-articles/ulta-outlines-online-marketplace-plan-after-posting-q4-comp-gain/

That's my sector.